Asset Managers Stick to London as New UK Tax Rules Take Hold

The UK’s new “asset holding company” tax routine received off to a balanced commence in 2022, and US and world-wide expense funds are possible to push advancement in the use of this new motor vehicle about the coming year.

The Qualifying Asset Keeping Providers structure will allow expenditure cash (as effectively as institutional traders these types of as pension money, coverage, sovereign wealth, and charities) to keep and manage investments by means of an onshore auto in the United kingdom with the profit of a very simple and reduced-price tag tax remedy.

The British isles has very long made available tax exemptions for holding organizations of trading teams, but the new QAHC routine goes substantially more in letting a large range of financial investment belongings (which includes credit devices, warrants, minority equity, and world-wide actual estate) to be managed as a result of the British isles with minimum tax drag. The United kingdom launched the QAHC routine to retain attracting the worldwide asset management community to London, and there are early signs that this expense is having to pay off.

Around 120 QAHCs have been registered with the British isles tax authority, and extra are envisioned as fund supervisors elevate their following rounds of expenditure. Original interest in the new regime has been specifically solid for credit and specific cases strategies. But all asset professionals with Uk-based investment industry experts in the Uk will be weighing the option to simplify their worldwide functions back into London in excess of time.

Environment up United kingdom holding companies for resources remaining lifted in 2023 could be a intelligent response to ongoing tax modifications likely to have an impact on the conventional holding jurisdictions—such as Luxembourg—in the coming a long time.

By style, a British isles QAHC must be able to spend in Uk and international (including US) securities and true property and repatriate profits and gains throughout a wide expenditure spectrum devoid of incurring any significant British isles tax value. A QAHC also really should be capable of accessing the UK’s community of tax treaties to mitigate taxes and withholding in fundamental investment decision jurisdictions.

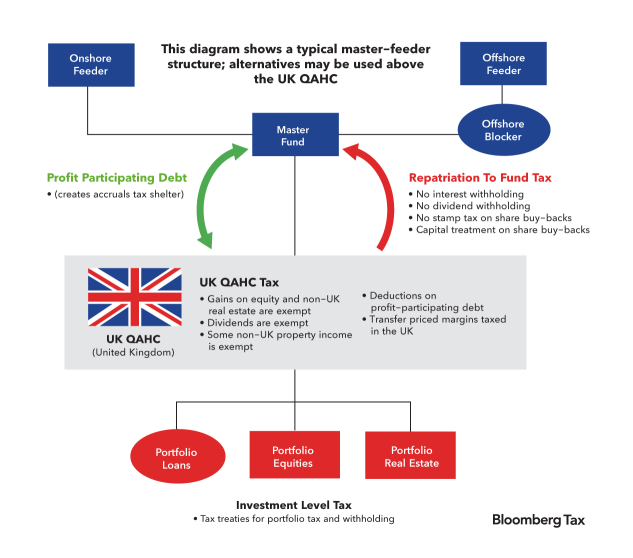

The diagram down below illustrates the workings of a British isles QAHC in simplified sort.

Exempt gains: A QAHC will be exempt from British isles tax on gains on disposal of a extensive array of fundamental securities, such as shares and warrants no matter of shareholding or possession proportion the exemption also applies to non-United kingdom real estate.

Exempt dividends: A QAHC will be exempt from tax on most dividends acquired in the same way as an ordinary United kingdom corporation.

Tax treaties: A QAHC ought to have the very same obtain to the UK’s network of tax treaties as an normal British isles firm to mitigate underlying tax expenses and get a larger share of gross investment decision proceeds. Each individual expenditure jurisdiction will have to have to figure out the ideal Uk link for the QAHC, but just one run by financial commitment specialists in the British isles should be able to claim treaty added benefits in which relevant—although particular treaties such as the a single concerning the British isles and the US may impose added circumstances.

Tax shelter for money: A QAHC will benefit from accruals-based mostly deductions on several kinds of earnings-collaborating debt, which will allow these vehicles to be funded with instruments that build efficient and timely tax shelters for cash flow-producing assets this kind of as loans or bonds. This final results in only a little margin of taxation in the British isles on this kind of cash flow.

No withholding: There will be no Uk withholding on possibly dividends or interest payments built by a QAHC to its buyers, which includes on the essential income-collaborating instruments that are applied to fund the fundamental investments.

Limited transfer or money taxes: A British isles QAHC will be exempt from many British isles transfer or cash taxes that may well if not apply, and investors are unlikely to bear these as a serious value.

British isles Expenditure Team. The use of a United kingdom QAHC should really also allow for any investment decision industry experts primarily based in the United kingdom to participate in returns (by means of co-investment or efficiency returns) on a streamlined basis for Uk tax reasons. The net consequence of a effectively structured QAHC should be that some United kingdom tax is levied on marginal income recognized on earnings-generating assets—determined below transfer rules, but in most instances anticipated to end result in a sub-1{d616ec9028684cd1d98e2ce20ddd83529d937fc361d92b53bbf35263833540c8} margin taxed at the 25{d616ec9028684cd1d98e2ce20ddd83529d937fc361d92b53bbf35263833540c8} Uk corporation tax level starting up in April —and that expense proceeds can normally be obtained in the United kingdom and passed again to investors flexibly and with no undue tax friction.

To elect a business into the QAHC tax regime, a couple aim circumstances will have to have be satisfied.

British isles tax home: A QAHC will want to be a British isles tax resident, whilst it could nonetheless be established up beneath non-Uk company regulation if chosen.

Ownership: At minimum 70{d616ec9028684cd1d98e2ce20ddd83529d937fc361d92b53bbf35263833540c8} of the QAHC’s traders want to be of a specified form. This features pension funds, insurance firms, sovereign prosperity resources, and charities but also lets most typical financial investment cash to qualify on their personal deserves without needing to trace as a result of to their best buyers. Money on the lookout to depend on this route to qualification should, however, pay back interest to their advertising tactic and supplies early on.

Financial investment business enterprise: A QAHC must only have on an financial investment organization, and other pursuits can be no far more than ancillary to this primary organization. Financial loan origination and restructuring action (for credit or unique circumstances) will need some tailoring into the QAHC tax routine, but most “long” financial investment procedures should really normally be able of slipping within just this need.

No outlined equities: The exception to the earlier mentioned is for platforms pursuing a system of investing in listed equities. There are possible exceptions for holdings of outlined equities that are ancillary to a wider investment decision mandate (for instance, holdings of smaller stakes following an IPO or stake-creating in advance of a get-personal), but a QAHC motor vehicle normally shouldn’t be made use of to build a portfolio of detailed, liquid equities.

No REITs or listing: The QAHC by itself simply cannot be a United kingdom REIT or have any equity securities shown or traded on a community market. If the circumstances are assessed adequately , most mainstream financial commitment funds across credit rating, particular circumstances, personal equity, enterprise, and serious estate must be capable to consist of a United kingdom QAHC inside of their fund keeping constructions. It is also probable for present investment decision vehicles—including these offshore in places these kinds of as Luxembourg—to be brought into the United kingdom and elected into the QAHC routine.

This write-up does not automatically reflect the belief of Bloomberg Industry Team, Inc., the publisher of Bloomberg Legislation and Bloomberg Tax, or its owners.

Creator Information

Oliver Currall is a Uk tax law firm and chartered tax adviser and co-heads Sidley’s tax group in Europe. A sizeable section of his exercise focuses on advising customers on the structuring of financial investment resources and asset holding buildings.

Noam Waltuch is a companion in Sidley’s US tax team. His practice principally focuses on advising customers on the US tax difficulties involved with the structuring and development of expense resources.

Fraser Tudor is an associate in Sidley’s London workplace and has a broad United kingdom and cross-border tax advisory and transactional follow.

We’d adore to hear your wise, primary acquire: Produce for us.